Video KYC - An Economic Solution for Advisors

The days were gone where initiating investment seems to be a long step process and involve physical presence of the parties as the investor had to visit authorized center for the verification. Due to the dynamic trend in the business technologies no method persists for a longer period like such the traditional pattern is even replaced with the emerging solution.

Although the previous form of collecting KYC seems to be expensive which was adding the operational cost for the firm. While from the perception of investors standing in a long queue was hectic and inconvenient method of getting verified.

What’s New?

Being a busy schedule of every individual time is a crucial asset for investors and advisors too which is spent in a planned manner. Thus keeping in mind the same thing a new initiative of home based KYC has been introduced popularly known as Video KYC in the

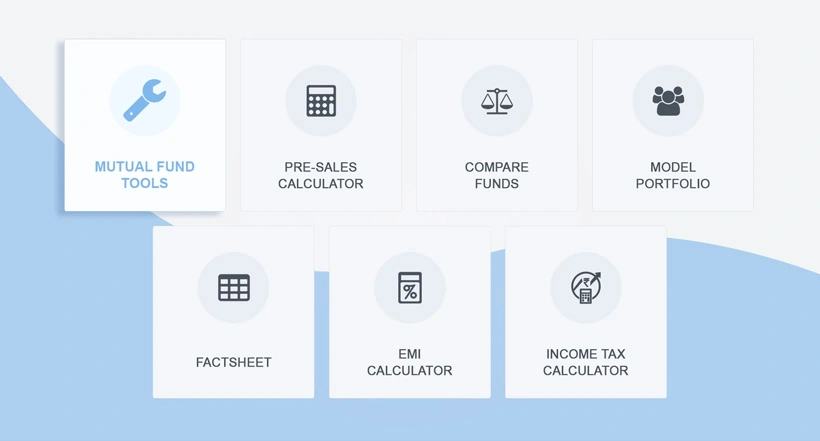

Mutual Fund Software for Distributors

which allows advisors to collect initial formalities of investors through online portal.

Sometimes a prospect showing genuine interest to deal with the advisor later denies just because of the complexities and interruptions in the verification process. In order to keep the prospects enthusiastic the Video KYC is a tool of attraction which allows them to get registered from the comfort of their home.

The digital form of collecting client’s information is the future of business and with same perception the trending feature has been introduced in the platform with an aim to assist advisors and their clients in accomplishing KYC formalities from any location across the globe.