How Does Technology Reduce the Manual Workload for MFDs?

In the hectic life of a Mutual Fund Distributor, every minute counts. While business growth is proportional to revenue-generating activities, you often find yourself stuck in non-revenue-generating tasks for most of the day.

Drowning in paperwork, and spending valuable hours on administrative duties takes up all the time that could have been used to focus on new client interactions and business growth. Frustrating, isn’t it?

Everyday Hustles of MFDs

If you find yourself spending the majority of your day stuck with the following activities, you might require a change.

Paperwork Overload: You are often stuck in loads of paperwork instead of engaging with clients.

Delayed Onboarding and Transactions: Papertrail onboarding and Slow transaction processing times affect client satisfaction and your business efficiency.

Manual Report Sharing: You spend most of your day engaging with existing clients and generating and distributing client reports.

Managing Large Portfolios: Managing large volumes of portfolios consumes a lot of your time and efficiency.

Operational Complexities: Day-to-day tasks are often tangled in unnecessary intricacies, eating into productive hours.

Technology To Overcome Manual Workload

Are you guilty of being stuck in manual tasks that don’t generate revenue? Do you find it tough to focus on business growth? It happens to the best of us!

MFDs, in a world where technology brings movies to your screen, delivers food to your doorstep, and connects you globally, why keep your business offline? It's about time you gave your business the push of technology. It can automate processes and boost your business growth exponentially, leaving you more time to focus on revenue-generating activities.

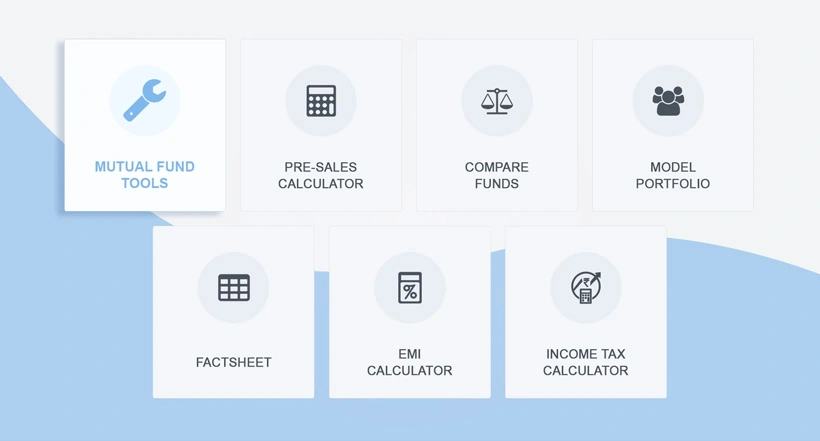

Technology in the form of mutual fund software automates business processes with various tools and features backed by research. Here are a few of the processes that you can automate to save your time, manual workload, and effort.

Benefits of Automation For MFDs

Automation doesn’t just save your time, it makes your life easier in more than one way:

It increases your productivity and efficiency.

It elevates client service and satisfaction.

It reduces operational costs.

It strengthens compliance and risk management.

It redirects your focus to high-value activities for business growth.

Conclusion

Beyond what we’ve discussed, there’s a whole world of possibilities with technology. Wealth Elite, your trusted mutual fund software, does more than reduce manual workload or simplify operations with the listed features. It offers many tools and approaches that make your daily work easier, saving you time, boosting efficiency and productivity, and fueling huge business growth.