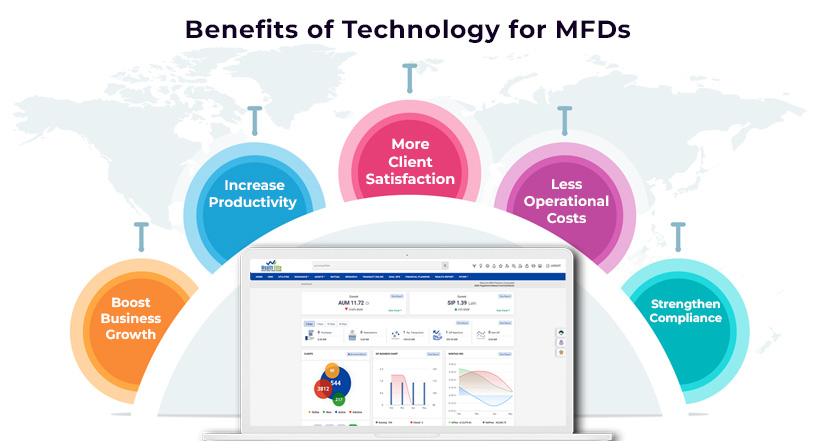

How Research Desk is proving a tool of success for advisors?

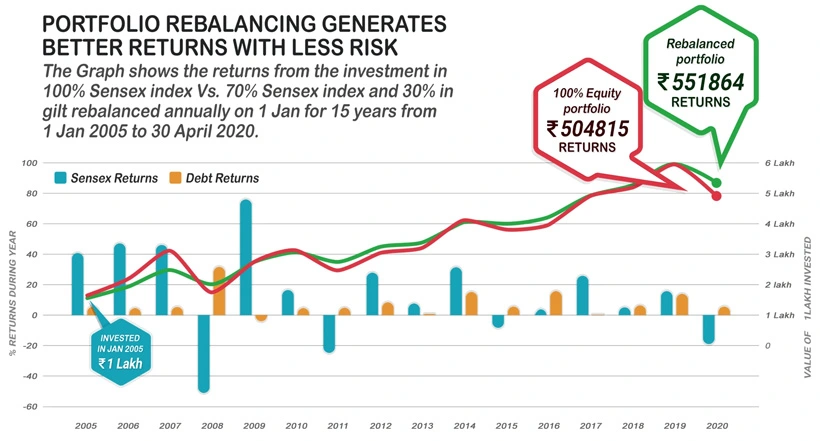

Since the launch of tool which has potential to perform research and calculations the accuracy of advisors is enhanced in predicting the future returns based on which clients are recommended to invest in most popular schemes. It’s because of the Mutual Fund Software who transformed the pattern of investment and made simpler within few clicks. Even the advisors with less span of experience is dealing efficiently with the clients and uplifting the status of investor’s portfolio.