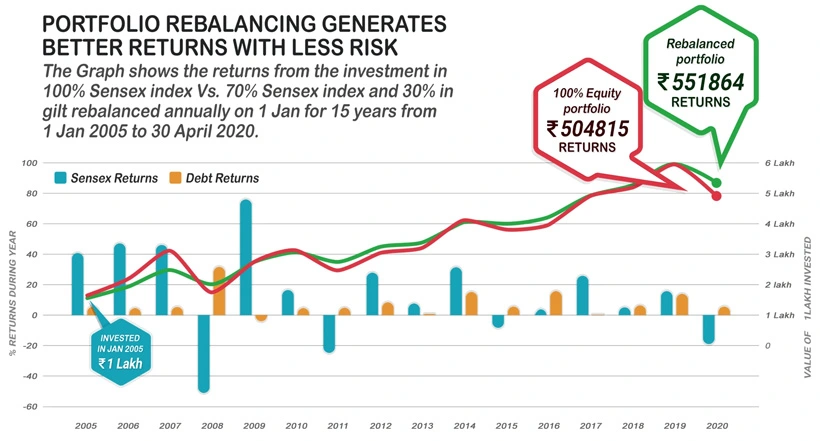

Why Portfolio Rebalancing is necessary to adopt by every financial advisor?

The market of investment is highly volatile as accurate predictions of movements is difficult for advisors and on other side risk reduction is also a priority in order to prevents funds from market loss. In such scenarios advisors are required to adopt a method or a strategy that proves beneficial at the time of frequent fluctuations in the values of investment and does not turn the profitable returns into a high loss. The Portfolio Rebalancing is effective technique for advisors that help them to derive returns even in the down market situation.