Unlock More Income Opportunities For a Stuck AUM Growth

MFDs, Mutual Funds Sahi Hai. But relying solely on mutual funds investments for revenue isn't

enough in today's competitive landscape. A report by SEBI suggests more than 50% of mutual

fund investments get redeemed within a year. Every redemption reduces your business growth

and the effort to get that investment done goes in vain. Do you still think only mutual

funds are enough for your business?

Diversify To Grow Your Business

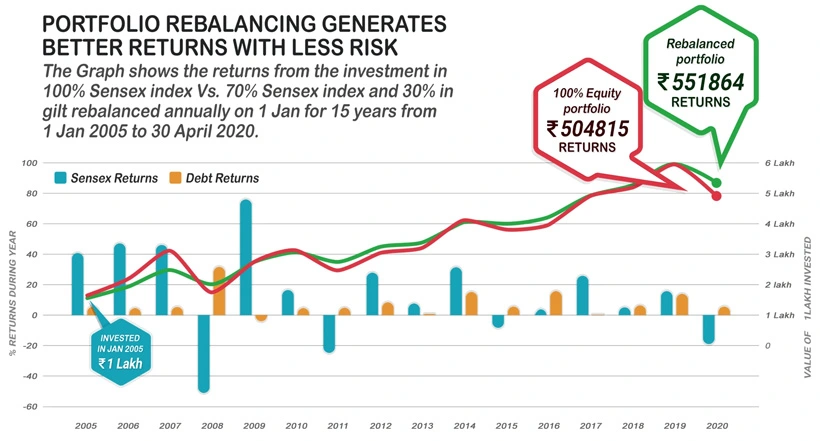

The remedy for your concerns lies in expanding your offerings beyond mutual funds and putting

only some of the eggs in a single basket. Many investment options are available today that

will not only help you diversify client portfolios but also reduce the impact of market

volatility on client portfolios with optimal risk-return balance, making investors stay

invested for the longer run.

National Pension Scheme (NPS)

NPS is a govt. backed retirement planning that scheme provides tax benefits and a secure

long-term investment avenue.

Approx 17 million subscribed to NPS across India in the FY 2023.

While it doesn’t offer direct commission, it exposes you to a large client base.

Peer to peer Lending (P2P)

P2P lending involves direct lending between individuals opening new investment avenues, and

diversifying client portfolios beyond traditional options.

Loans Against Mutual Funds (LAMF)

LAMF offers clients liquidity without liquidating mutual fund investments.

Global Investing

Global investments offer access to international markets and sectors, diversifying portfolios

across borders.

Indians are obsessed with Facebook, Apple, Amazon, Netflix and Google.

Investors with a high-risk tolerance and liking for global markets appreciate global

investments.

Liquid Funds

Liquid funds are a great way to invest for beginners or people who don't have enough money to

invest.

Investors can park their idle cash and liquidate instantly.

Liquid funds offer better returns than a regular savings A/c.

You can convert these investors who are prospects for your business into loyal customers

later on.

Benefits of Offering Multiple Assets

Diversifying your offerings isn’t just about money; it’s about securing growth:

Expanded Revenue Channels: Offering diverse assets increases your AUM, opens new

revenue streams alongside mutual funds, and offers increased trail income through a

diversified portfolio base.

Redemption Reduction: Diverse options retain clients, offer better returns,

reduce redemptions, and make clients stay invested in the longer run.

Conclusion

Diversification is all about broadening your investment spectrum to cater to diverse client

needs and getting them better returns while expanding revenue streams, AUM, and income for

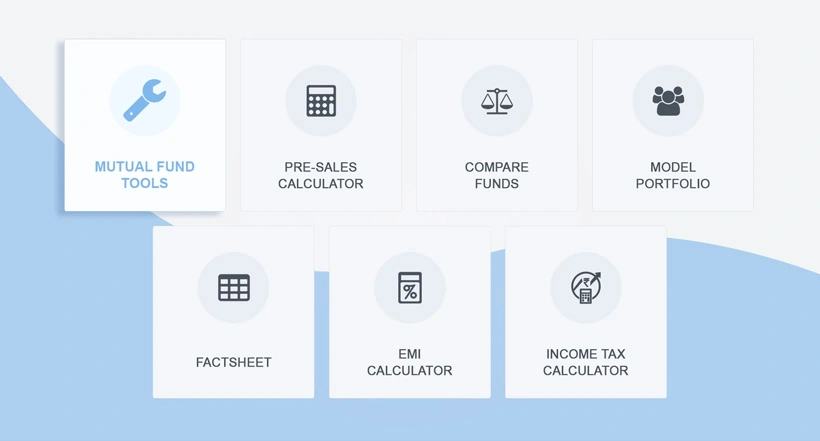

yourself. Wealth Elite, a reliable Mutual fund software enables you to easily offer and

manage all these assets through a single platform, making business growth convenient for you

with multiple revenue streams.